Get an LLC: How To Set Up Payroll For LLC. Business names, create an LLC, Business registration

& Company registration numbers. Easy Setup! Fast turn around time!

How to obtain an LLC – How To Set Up Payroll For LLC

To create an LLC, you will certainly need to adhere to these steps:

Select a name for your LLC that is not currently in use by an additional business as well as is compliant with your state’s naming laws. How to set up payroll for LLC.

Submit articles of organization with your state’s LLC filing office. This file formally creates your LLC and includes details such as the name and also address of the LLC, the names and also addresses of the participants, as well as the function of the LLC.

Obtain any kind of required licenses as well as permits for your business.

create an operating contract, which describes the management and also financial framework of the LLC.

Pay any type of required costs to the state for registering your LLC.

Keep in mind: How to set up payroll for LLC. The process for forming an LLC will vary relying on the state where you intend to create it. It is advised to consult with a lawyer or an accountant who can guide you on the certain rules and guidelines of your state.

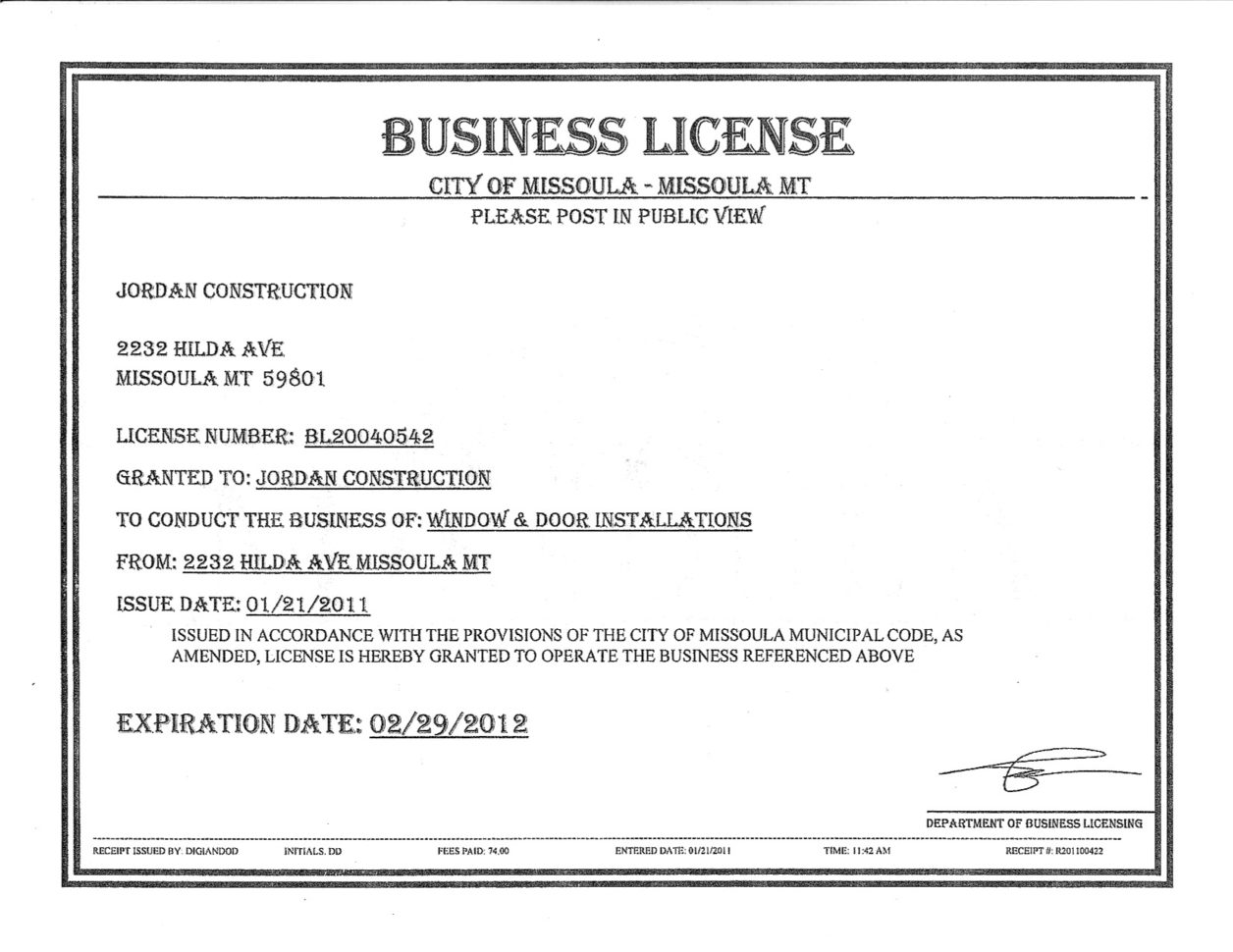

Exactly how to get a business license

Identify the sort of business license you need: Relying on the kind of business you plan to operate, you might need a details kind of license. For example, if you plan to sell alcohol, you will need a liquor license.

Research study regional as well as state demands: Each state and community has its own collection of regulations as well as laws for getting a business license. How to set up payroll for LLC. You’ll need to investigate the specific requirements for your location to guarantee you have all the needed documentation and paperwork.

Collect called for documents: You will require to supply certain papers, such as proof of your business name and address, tax obligation identification number, and proof of insurance coverage. Ensure you have every one of these files prior to looking for your license.

Get your license: Once you have all the needed documents, you can apply for your business license by sending the ideal documentation to your regional or state government firm. This can be done online, by mail, or personally.

Pay the required fee: How to set up payroll for LLC. You will certainly need to pay a fee to get your business license. The cost quantity varies relying on your place and the type of business you are running.

Wait on authorization: After you have sent your application as well as paid the called for cost, you will need to wait on your license to be authorized. The approval process can take several weeks, so be patient.

Maintain your license upgraded: How to set up payroll for LLC. Once you have your business license, you will certainly need to maintain it upgraded by renewing it yearly or as required by your regional or state government.

How ahead up with a business name – How To Set Up Payroll For LLC

Beginning by brainstorming keywords that connect to your business. How to set up payroll for LLC. These can include the products or services you provide, the target market, or any type of distinct functions of your business.

Think of the character or tone you desire your business name to share. For example, do you desire a name that is significant as well as professional, or something more enjoyable and also catchy?

Take into consideration using a mix of words that pertain to your business. This can consist of industry-specific terms, or words that show your business’s values or objective.

Play around with different word combinations and see what appears excellent. You can likewise make use of a business name generator device to assist you create ideas.

Check the schedule of your selected name by searching online and also inspecting if the domain is offered.

Obtain responses from buddies, family, as well as colleagues to see if they like the name and also if it shares the ideal message.

As soon as you’ve picked a name, make sure to register it with the suitable government firm and protect the necessary trademarks and also copyrights to protect your business name.

Exactly how to create an LLC

Choose a special name for your LLC: Your LLC name should be distinguishable from other business names on documents with your state’s LLC declaring workplace.

Select a signed up Agent: How to set up payroll for LLC. A registered Agent is a individual or business entity that will certainly accept legal papers in support of your LLC.

File articles of organization: This is the record that officially produces your LLC and also must be submitted with your state’s LLC filing workplace.

Obtain any essential licenses as well as authorizations: Relying on your business type and area, you might require to acquire additional licenses and also licenses.

create an operating arrangement: An operating contract is a legal paper that lays out the ownership and administration framework of your LLC.

Acquire an EIN: An EIN, or Company Identification Number, is a serial number appointed to your business by the internal revenue service for tax obligation functions.

Register for state taxes: Depending upon your state, you might need to register for state tax obligations, such as sales tax or payroll taxes.

Follow recurring compliance needs: LLCs undergo ongoing compliance demands such as annual reports and also franchise taxes.

Open a business savings account: Open a business bank account to keep your individual and business finances different.

How to set up payroll for LLC. File annual reports as well as taxes: LLCs are called for to file annual reports and taxes, talk to your state for details demands.

New Jersey business registration – How To Set Up Payroll For LLC

In order to register a business in New Jersey, the following steps need to be completed:

Select a business name: How to set up payroll for LLC. Business name must be distinct and not already being used by another business. The name can be looked for schedule with the New Jersey Division of Revenue and Venture Providers.

Register for tax obligations: How to set up payroll for LLC. All companies in New Jersey are required to register for state tax obligations, including sales tax, employer withholding tax, as well as unemployment tax obligation. This can be done via the New Jersey Division of Revenue and also Business Providers.

Acquire any type of necessary licenses or authorizations: Relying on the kind of business, particular licenses or authorizations might be called for. How to set up payroll for LLC. This consists of licenses for certain careers, such as healthcare providers or building professionals, in addition to licenses for sure tasks, such as food solution or alcohol sales.

Register for a business entity: Services in New Jersey can choose from numerous various sorts of lawful frameworks, such as single proprietorship, collaboration, limited liability firm (LLC), or company. How to set up payroll for LLC. The suitable framework needs to be selected based on the certain requirements of the business.

File articles of consolidation (if appropriate): If the business is a firm, articles of unification should be submitted with the New Jersey Division of Revenue as well as Venture Providers. This procedure consists of sending a certification of incorporation and paying a cost.

Register for employee withholding tax obligations: How to set up payroll for LLC. Companies with staff members must register with the New Jersey Division of Revenue and also Business Solutions to report as well as pay employee withholding taxes.

Acquire any kind of necessary insurance coverage: How to set up payroll for LLC. Depending upon the sort of business, specific sorts of insurance policy might be needed, such as workers’ compensation insurance coverage.

As soon as every one of these steps have actually been finished, business will be officially registered and also able to operate in New Jersey. It is very important to keep in mind that continuous conformity with state legislations as well as policies is additionally needed to maintain enrollment.

What is a business in a box? How To Set Up Payroll For LLC

A business in a box is a pre-packaged collection of sources, tools, and also products that are created to assist business owners rapidly and quickly begin as well as run their very own business. How to set up payroll for LLC. Some instances of business in a box consist of franchises, online organizations, and also home-based services.

How To Register business name

Select a one-of-a-kind business name: Prior to registering your business name, make sure it is unique and also not already being used by another business. You can make use of a business name search device to inspect if the name is readily available.

Determine the type of business entity: Choose the kind of business entity you wish to register as, such as a sole proprietorship, partnership, LLC, or company.

Register with the state: Most states require companies to register with the state government. How to set up payroll for LLC. This can commonly be done online or in person at the proper federal government agency.

Obtain any necessary licenses as well as authorizations: Depending upon the kind of business you are running, you might require to acquire particular licenses as well as licenses. These can differ by state and also market, so it is very important to research study what is needed for your business.

Register for tax obligations: Register for any necessary state and also government tax obligations, such as sales tax and income tax.

File for a DBA Doing Business As if necessary: If you’re operating under a name that’s different from your legal name, you’ll require to declare a DBA.

Keep records: Maintain all enrollment records, licenses and also allows in a safe place for future reference.

What is a Company enrollment number? How To Set Up Payroll For LLC

A company registration number, likewise referred to as a company registration number or business registration number, is a unique identification number designated to a company by a federal government company. How to set up payroll for LLC. This number is used to determine the company for legal as well as administrative objectives, such as filing taxes, opening up bank accounts, and also conducting business deals. The layout and also place of the enrollment number might differ relying on the country or state in which the firm is registered.

Northwest Registered Agent

Northwest Registered Agent is a firm that provides registered Agent solutions to businesses in the United States. They act as the official point of contact for a business, receiving as well as forwarding lawful records, such as service of procedure and also yearly records.

Incfile

Incfile is a company that offers business development services, consisting of LLC development, company development, as well as nonprofit development. How to set up payroll for LLC. They additionally supply solutions such as signed up Agent service, conformity services, as well as business document filing.

What is Inc Authority? How To Set Up Payroll For LLC

Inc Authority is a business that provides legal, tax, and also compliance services for services. How to set up payroll for LLC. They aid entrepreneurs and also small company owners integrate their companies, handle their legal as well as tax responsibilities, and ensure that they are in conformity with all relevant laws and also regulations. Their services consist of company development, signed up Agent solutions, hallmark enrollment, business license as well as permit assistance, and also more.

Zenbusiness

Zenbusiness is a company that uses business development and assistance solutions to business owners as well as little business proprietors. They offer assistance with setting up a brand-new business, consisting of selecting a business framework, acquiring necessary licenses as well as authorizations, and signing up with state as well as government companies.

Swyft Filings

Swyft Filings is a US-based on-line lawful service that supplies an economical as well as easy means for organizations to include or create an LLC (Limited Liability Firm). How to set up payroll for LLC. They use a range of solutions consisting of business registration, trademark filing, and also annual report services. Swyft Filings is known for their straightforward web site and also their dedication to providing a quick and effective solution. They likewise use a 100% fulfillment assurance and a online licensed Agent service.